You will get more from your employees and they will be more committed if you share equity immediately in a meaningful way, so that everybody rises up.

– Mark Cuban, entrepreneur, television personality, media proprietor

Employee share option plan (ESOP) are widely becoming accepted as forms of compensation, in addition to traditional cash. Invented in 1956 and made popular in Silicon Valley, ESOP’s has spread globally has accepted and even preferred form of compensation, especially for fast growing private companies.

A new trend in compensation has emerged, led by the crypto and blockchain community, using the very coin from the project itself as team compensation .Even in some situations tokens have been the exclusive form of compensation with teams are forgoing cash and equity entirely.

However, are tokens the same as equity?

Employees and Equity

Offering ESOP is a great way to make employees owners in a company, creating great incentives for them to remain in the company. This form of incentive can also help employees align with the company’s long-term objectives. As owners, employees will be encouraged to build the company for long-term success. ESOPs also transfer the company’s wealth into the hands of employees, which boosts recruitment and retention.

ESOP are attractive because if a company does make out in the long run, the equity compensation can be substantial. For instance, many Google and Facebook early employees became millionaires because of their equity programs.Equity represents ownership in a company. Companies usually raise capital by issuing equity (selling shares) and in return, shareholders receive certain rights such as voting access to dividends and any future gains in an event of a sale or initial profit offering.

ESOP is the certain type of program that allows employees and other related individuals the optional right to buy a set number of shares at a predetermined price within a set time (exercise period). These shares are reserved and “locked” until the designated time is over; the process is called “vesting”. Employees exercise their options to buy shares when the company deems it is time, this usually at some liquidity event such as a fundraise, trade sale or at an IPO. The employees buy the shares at a pre-set price and known as the strike or exercise price, that is usually lower than the current fair market value of the shares.

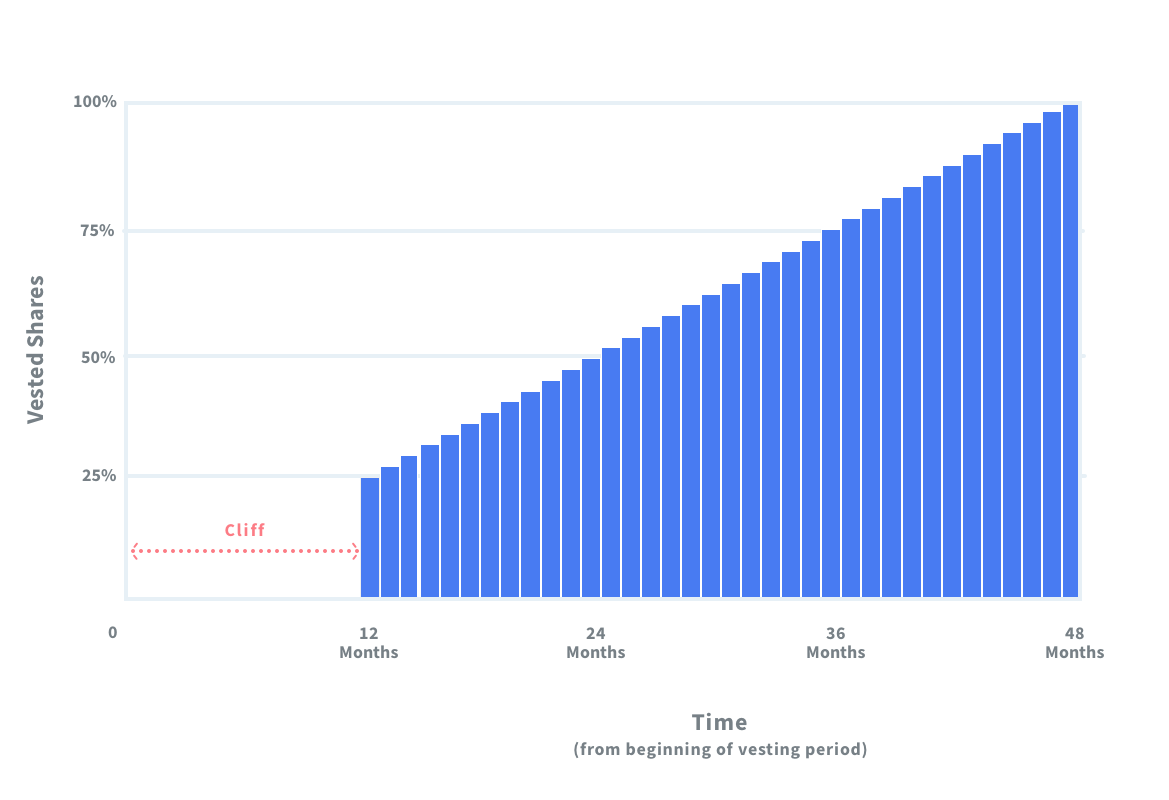

From the employees’ perspective, equity as compensation can seem like a long-term value proposition. It usually takes around three to four years for equity compensation to vest fully and typically companies will additionally award the first tranche of vested options after an initial wait period, which is called a “cliff”. Companies set vesting schedules with a cliff as a protective measure to ensure the option holder is a long term fit as well as protection against employees pre-maturely leaving the company.

The Ideal Equity Plan

The “ideal” equity award plan is one that is tailored to consider and reflect the stage of business and industry they operate in, the nature of the workforce, the organization’s culture and desired outcomes. The amount of options should also be a function of the compensation structure of the company and the market conditions. In terms of planning and hiring,a common problem is how much equity to grant in an offer. It is tempting to compare the percentage of ownership from company to company, but the most important metric is the actual value of the grants relative to the cash and other comparable compensation.

Andy Lee, CEO of Sprout, suggests that employees understand their actual value of the grants, percentage ownership and the projected value of the company’s growth. For example, he advises hiring managers to compare the cash value of the equity combined with cash and equivalent offered to a full cash-only compensation in the marketplace. Successful founders and recruiters of cash-strapped startups and founders are clearly communicating the value of the options as additional value to the cash they can offer to candidates.

Vesting and How It Works

Vesting is the process through which some equity and tokens are distributed. There are four common types of vesting schedules: time based and milestone vesting schedules. Time-based can be in a linear vesting, graded or as a customized schedule. Linear time is simply an equal amount distributed over a set schedule. In graded or customized time-based schedules, also known as twisted vesting, you can see increasing amounts distributed or a balloon structure at the end (or beginning). For example, some graded vesting schedules at Amazon follow 10%-20%-30%-40% over a four-year schedule. In the milestone vesting schedule, equity or tokens are distributed based on the achievement of predetermined milestones, such as individual or team performance.

During a cliff, no equity or tokens are released, as it serves as a trial period during which vesting accrues. After the cliff period, the vested parties will receive equity or tokens in a time and/or milestone based schedule.

In equity vesting, options enable holders to buy future shares that have yet to be issued. Counting future, “convertible” shares is an important part of the calculation of “fully-diluted” shares for ownership and equity cap table calculations.

Token vesting, also known as “token lock-up”, is the process of removing a specific portion of the total number of tokens from circulation and “re-releasing” them on a schedule. These tokens are frequently released over a predetermined time frame, which is typically years stipulated via a token vesting contract. Not only is vesting important component of team compensation, but investment and other token grants are also distributed with vesting schedules. This is also an important mechanism to prevent investor “pump and dump” schemes, sudden dilution and volatility when tokens are released.

Tokens vs Equity

Like traditional companies offering ESOPs, blockchain and crypto projects offer tokens as a form of compensation, often as the only form of compensation Shareholders in these projects are awarded tokens in line with their compensation and contributions. Usually, tokens are offered to project founders, advisors, team members, and others who contributed to the project. This distribution can take place before the tokens are sold to venture capitals (VCs), private capitals, or the public through initial coin offerings (ICO) or initial DEX offerings (IDO).

Because tokens have perceived monetary value, they also have income tax implications similar to ESOPs. Tokens that are awarded to the team as compensation are usually referred to as “token vesting” because they are usually “unlocked”.

Tokens are fundamentally different from equity in several aspects. Firstly, tokens do not necessarily represent ownership of the organizations or even the project itself. Ownership of company shares includes shareholder rights as well economic interest in the business in profits, dividends or capital gains in the event of a liquidation event. What is currently trending for crypto and blockchain projects are fundraising via equity raising and investors are asking for additional rights to existing or future tokens, creating ownership confusion around ownership of both classes of assets for founders and stakeholders.

Compared to cash and equity, tokens theoretically should sit in between in terms of liquidity and upside. Tokens have been based on perceived market value and because of it’s decentralized nature, is more liquid and volatile than equity, which has additional restrictions, but with time, can see outsized growth in value vs tokens. Equity typically has a longer wait time for liquidity, but usually is matched with a greater upside than tokens.

Another key difference with equity and tokens is that after claiming or receiving the vested tokens, they are completely available to the employees to sell, lend, stake, or swap into other cryptocurrencies (considering there is a market for them). The employers can offer tokens with a fixed value, or the tokens can be linked to the market or fiat (dollar) value. Compared to tokens, when one exercises the right to buy equity, the stakeholder will typically sign an exercise agreement to abide by the terms and conditions outlined in the shareholders agreement, which can include further lock-ups and restrictions on share transfers and sales.

Finally, the one thing that will be universal will be the tax treatment as a form of income. Personal income taxes are levied on both gains of equity and tokens. In the eyes of the tax authorities, one is levied taxes based on the economic gains for either asset. In equity, you either taxed on the gain from the “spread”, what you paid and the current fair market value. In the case of restricted stock, the spread will be the entire value of the shares. This is similar treatment for tokens as token holders typically do not pay to acquire the tokens. Depending on the jurisdiction, the employer may have to report and/or withhold the tax.

Using a comprehensive equity and token management tool for grants and vesting.

A platform like Sprout assists companies in managing their ESOP and token vesting plans digitally and removes the manual dependency of spreadsheets or single-function tools. Sprout is the first in ownership management to provide a full-scale equity and token management platform that offers education, onboarding, and self-service options that help companies understand and manage team compensation using traditional ESOPs or token vesting. Folium, created by Sprout, also enables companies to track and manage all relevant wallet transactions, off-chain convertibles, and token vesting on any blockchain.

Also, for more information on how equity is treated, please check out Sprout’s ESOP and related insights and our newly released regional tax cheat sheet. For applications of tokens, please refer to the regional tax treatment of restricted stock.

Want a simpler way to manage ownership? Visit Sprout for more information.